As summer travel heats up worldwide, the Maldives takes bold steps to shine brighter than ever on the global tourism stage. The Maldives Marketing and Public Relations Corporation (MMPRC), known as Visit Maldives, has launched a wide-ranging summer campaign across key international markets to boost brand visibility and drive bookings for the idyllic Indian Ocean paradise. This multifaceted effort not only strengthens the Maldives’ position as a top luxury getaway.

As part of this dynamic push, Ibrahim Shiuree, CEO & MD of Visit Maldives, highlights the bigger picture behind these efforts:

“This summer campaign is part of a broader effort to intensify our presence in key markets where we see significant potential for immediate arrivals and long-term growth. We aim to build sustained interest in the Maldives as a top-of-mind destination by combining on-the-ground activities with strategic media placement and global partnerships.”

Why the Maldives is the Ultimate Summer Escape

Known for its crystal-clear turquoise waters, powder-white beaches, and overwater villas that epitomize luxury, the Maldives offers an unbeatable summer retreat for travelers seeking both relaxation and adventure. Unlike many traditional destinations, the Maldives’ tropical climate creates a year-round haven, with summer bringing warm sunshine and vibrant marine life—perfect for diving, snorkeling, and serene beach days. Beyond natural beauty, the Maldives’ rich culture and world-class hospitality ensure every visitor experiences something truly special.

Global Reach Through Strategic Partnerships and Campaigns

To capture the attention of high-value travelers, Visit Maldives capitalizes on powerful global alliances and sophisticated marketing across its top source markets.

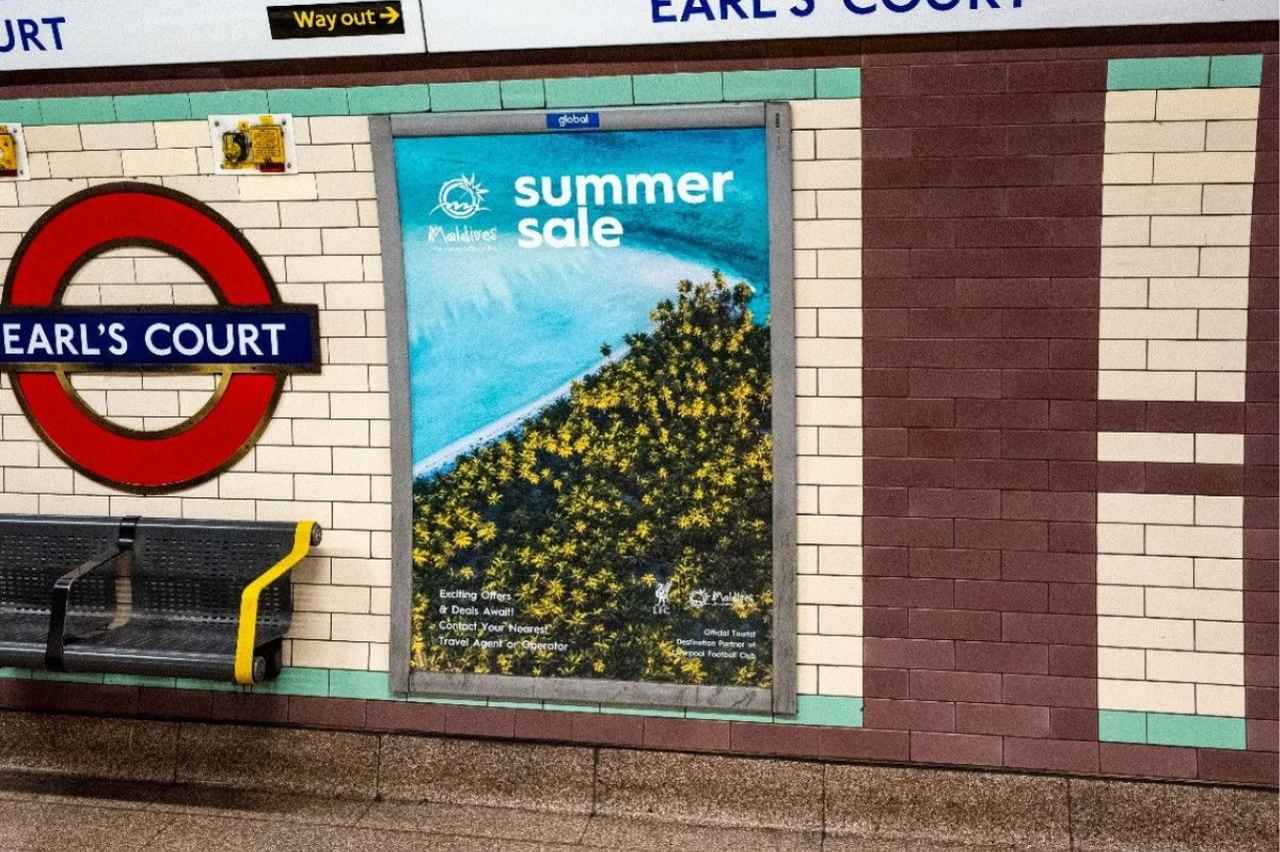

United Kingdom: The Maldives secured a high-profile partnership with Liverpool FC, positioning itself as the club’s Official Tourist Destination Partner. This alliance amplifies the Maldives’ brand visibility among millions of football fans worldwide. The UK campaign features extensive out-of-home (OOH) advertising, including eye-catching ads on London’s underground and buses, alongside taxi promotions that keep the Maldives front-of-mind for British travelers planning summer vacations. Additionally, a collaborative campaign with TravelBag (DNATA UK) aims to boost engagement and summer bookings.

Russia & CIS: Visit Maldives works closely with PAC Group and Resort Life Travel to offer personalized luxury experiences tailored to Russian-speaking tourists, ensuring the Maldives remains a preferred summer destination in this region.

Europe’s DACH Region (Germany, Austria, Switzerland): A strong ongoing campaign with travel giant TUI leverages their extensive retail and online network to promote Maldives vacations, targeting both B2B and B2C audiences. Supplementary collaborations with DER Tour and Alpitour in Germany and Italy respectively create tailored packages and increase bookings through well-established travel agencies.

Poland and Spain: Promotional campaigns with TUI Poland and Travel + Leisure magazine tap into affluent, travel-savvy audiences, elevating the Maldives’ status as a must-visit summer locale.

India: Recognized as a key market, India hosts a robust suite of initiatives, including partnerships with major travel platforms like MakeMyTrip, TBO, and Pickyourtrail. These efforts are supported by high-profile celebrity endorsements and exclusive campaigns with Bollywood director Farah Khan.

Digital & Influencer Engagement to Drive Bookings

In addition to the above summer campaigns, Visit Maldives is rolling out a special Summer Sale campaign across its social media platforms, featuring exclusive offers designed to spark inspiration and drive holiday bookings during the peak travel season. Supporting this push, a curated series of influencer activations targets key source markets, delivering aspirational content across Instagram, YouTube, and TikTok.

Setting the Stage for an Unforgettable Summer in the Maldives

With a strategic focus on strengthening trade partnerships and highlighting the Maldives’ unique summer appeal, Visit Maldives is driving early bookings not only for the upcoming peak season but also for the 2025-2026 winter months. By addressing the seasonal marketing gaps from the previous year, these well-coordinated campaigns secure a sustained presence in key markets and keep the Maldives top of mind for discerning travelers.

Backed by its unmatched natural beauty, luxurious accommodations, and global outreach, the Maldives is firmly positioned as the ultimate summer escape in 2025. Whether travelers seek peaceful beaches, vibrant underwater adventures, or rich cultural experiences, this Indian Ocean paradise offers an extraordinary getaway, made even more accessible thanks to Visit Maldives’ dynamic and ambitious summer campaign.